Trusted By 50,000+

Housing Providers

- Affordable Credit Reports

- Data-Driven Background Checks

- Trusted Rent Reporting Services

- Easy To Use Recordkeeping

- Proven Debt Recovery Methods

Products That Support You

Designed for Housing Providers of all scales, Tenant Screening, Rent Reporting, and Recordkeeping services.

Report

Rent Payments

Screen

Applicants

Access affordable and easy to read Credit Reports and Background Checks.

Utilize

Recordkeeping

Manage your rental income and payment history with seamless records.

Report

Rental Debt

Reduce the time, stress and costs spent recovering rental debt owed.

Proudly Featured In

Trusted By 50,000+ Housing Providers

With 1,000,000+ Rental Units

Get started in just minutes and gain access to a range of powerful tools proven to save you both time and money every month.

Proven Rent Reporting

With our Rent Reporting services, Landlords and Property Managers can report on-time, late and nonpayment to Credit Bureaus. Housing Providers who choose to implement Rent Reporting can attract responsible Tenants who prioritize fulfilling their lease agreement and may be interested in receiving credit for on-time rent payments.

Tenants who consistently make on-time payments have the option to participate and can opt-in to have their payment history shared with the Credit Bureaus. In cases where a rental agreement is intentionally broken due to nonpayment of rent, the associated debt may be shared with Credit Bureaus, and reflected on the debtor’s Credit Report. Learn More

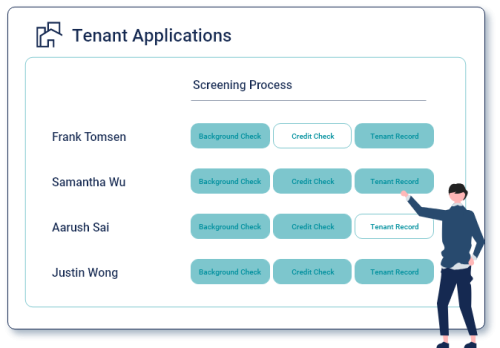

Trusted Tenant Screening Services

Our Credit Reports and Background checks are easy to read, instant and affordable. Credit Reports may include credit score, current and former addresses, employment addresses, employment confirmation, credit history (tradelines), credit balances, collections, bankruptcies and inquiries.

For additional peace of mind, you can add a Tenant Background Check to your screening process. We offer a real-time public information search that utilizes over 110,000 databases from over 240 countries. A Background Check can provide further insights into criminal records, court decisions, negative press, past employment, and more. Learn More

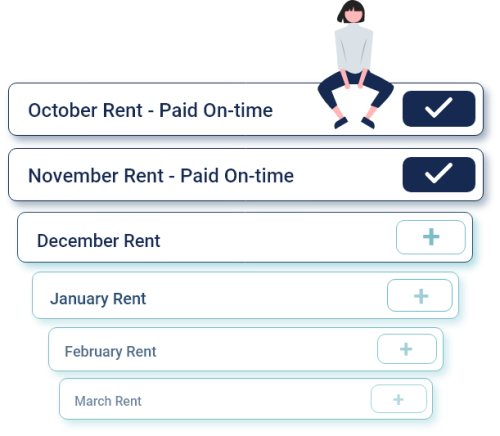

Streamlined Recordkeeping

Included for free with your FrontLobby membership is our effective Recordkeeping tool. It is designed to be simple and easy-to-use and can help you keep track of your rental finances. Monthly on-time payments can be tracked, as well as any late or missed payments. If the lease terms change or a payment plan is agreed upon, you can update the record in just a few seconds.

Multiple leases? No problem. FrontLobby can handle unlimited leases, so you’ll always be able to keep track of your finances no matter how many properties you have.

Effective Debt Recovery Tools

FrontLobby provides peace of mind for Landlords and Property Managers facing the financial stress of rental debt from former lease agreements. You can report rental debt to Credit Bureaus for the purpose of collecting the outstanding balance.

For Tenants who wish to clear the rental debt but require additional time, FrontLobby enables payment plans. When both the Landlord and Tenant agree, a payment plan can be a win-win, Tenants can still build credit while Landlords reduce their rental debt. Learn More

Valued by Housing Providers, Loved by Renters

February 16th, 2025

January 5th, 2025

January 15th, 2025

December 1st, 2024

December 4th, 2024

December 9th, 2024

December 11th, 2024

June 15th, 2024

December 15th, 2024

November 15th, 2024

February 28th, 2024

March 20th, 2024

October 8th, 2024

October 27th, 2024

September 8th, 2024

March 20th, 2024

February 28th, 2024

March 20th, 2024

February 28th, 2024

February 28th, 2024

September 22nd, 2024

July 28th, 2024

February 28th, 2024

June 10th, 2024

March 7th, 2023

February 1st, 2023

January 31st, 2023

April 28th, 2023

June 4th, 2023

May 15th, 2023

June 8th, 2023

June 19th, 2023

December 7th, 2022

June 6th, 2022

October 29th, 2022

January 31st, 2022

September 9th, 2022

August 20th, 2022

December 21st, 2022

April 20th, 2022

September 22nd, 2022

June 2nd, 2021

March 6th, 2021

May 25th, 2021

November 20th, 2021

November 19th, 2021

May 23rd, 2021

May 11th, 2021

June 2nd, 2020

March 2nd, 2020

+ We are committed to earning 6 out of 5 stars from our members.

Common Questions

There is no need for a software integration to use FrontLobby, however, we have those too. If you are interested in an integration with Yardi, or another property management software tool you can contact our sales team here.

Rent payments do not need to be made through the FrontLobby platform for Rent Reporting to Credit Bureaus to work. We know being a Housing Provider requires flexibility, this means being able to accept rent payments in whichever way works best for you. You can learn more about how Rent Reporting works here.

Absolutely not, we are an inclusive platform that works for Landlords and Property Managers of all sizes. We’ve designed it to be easy and fast to use, with no minimum lease requirement. Housing Providers can sign up for free here.

FrontLobby is a trusted partner for your business. Our platform offers Rent Reporting to Credit Bureaus, Tenant Screening services, and Debt Recovery options.

Our Tenant Screening services can help you find the best renters at an affordable price. We offer instant Credit Reports and Background Checks that are designed for Landlords and Property Managers.

Our Rent Reporting tool can help reduce Tenant delinquencies while giving Renters the opportunity to build credit. Rent Reporting can also help to attract responsible renters that value their credit profile, improve Landlord-Tenant communication with automatic Tenant notifications, and increase operating efficiencies with our free Recordkeeping tool.

Our Debt Recovery option can help recover unpaid rent from former Leases.

Ready to sign up? Housing Providers can get started for free here.

For Housing Providers, Rent Reporting and Debt Reporting can be two of the easiest ways to reduce Tenant delinquencies and recover rental debt from former leases. When on time and missed rent payments are shared with Credit Bureaus, like Equifax and Landlord Credit Bureau, Tenants have proven to prioritize rent. Additional benefits can be found here.

For Renters, good credit builds over time and can require a mixture of credit accounts. With FrontLobby, rent payments are reported as a trade line on a Tenant’s Credit Report, one of the proven ways to help build a strong credit report. Additional benefits can be found here.

With FrontLobby rent payments can be shared with Equifax and Landlord Credit Bureau to be reflected on a Tenant’s Credit Report and Tenant Record.

Our Tenant Screening services are used by Landlords and Property Managers who want an affordable screening solution that is delivered instantly. There are no hidden fees, no mandatory subscriptions, and no additional cost for credit score.

FrontLobby offers instantaneous, easy to read Credit Reports pulled directly from Equifax. Every Credit Report includes available credit score, current and former addresses, employment confirmation, credit history (tradelines), credit balances, collections, bankruptcies, and inquiries.

Canadian Housing Providers can add a Background Check, that searches over 110k databases in 240+ countries to provide critical information on an applicant. Background Checks provide information on the applicant’s employment, historical addresses, education, criminal records, court decision, public press releases and more.

Visit our pricing page here to see how affordable our Tenant Screening is.

Survey’s show that over 50% of Renters want to improve their credit. FrontLobby is a great way for Tenants to report their rent payments to Credit Bureaus, like Equifax and Landlord Credit Bureau.

You may have received an invite from your Tenants. If this is the case, please use the link in the email invitation to sign up. It is free and only takes a few minutes. Once your account is complete you can log in to view your Tenant’s draft lease. Review the details and either approve or share required changes.

Even if your Tenant is the one to initiate rent reporting, your approval is required. This helps to ensure the integrity of the data.

FrontLobby aims to facilitate proactive and positive conversations between Housing Providers and Renters. When applicable, we encourage all parties to work towards a mutually agreeable payment plan.

If a payment plan is in place and a Tenant is paying according to the plan, no debts may be reported to the Credit Bureaus. Payments according to the payment plan should be recorded as being paid on time and the Tenant may use them to build their credit. However, if a Tenant stops paying according to the payment plan, the total outstanding debt may be recorded.

If a Tenant believes a debt is being reported when there is a payment plan in place, please follow our dispute process outlined here.

Every time we receive a great question, we add it to our Help Center. Using this great resource, you’ll find the answer to almost every question.

Helping Housing Providers and Renters Prosper

Join our mission to improve the rental industry for everyone.