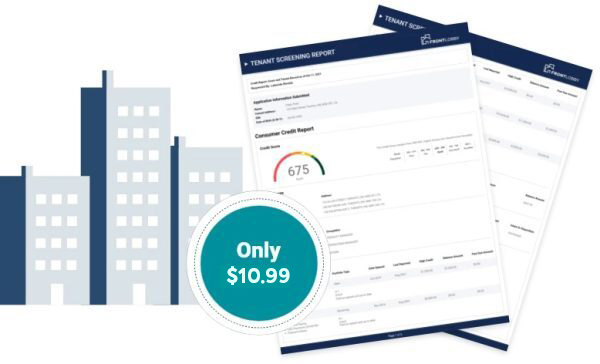

A Tenant Credit Check

For the Rental Industry

- Long-form Credit Report with Credit Score

- Current and Former Addresses

- Employment Confirmation

- Credit History (tradelines)

- Credit Balances, Collections, Bankruptcies

- Inquiries and Aliases

What Does A Credit Check Include?

All the Information You Need, None of the Gimmicks

Best Price

Canada's first affordable Tenant credit check that includes score, and no hidden fees.

Delivered Instantly

Canada's quickest Tenant credit check, ready in under 5 minutes with zero hassle.

Easy to Understand

Canada's best Tenant credit check, designed to be easy to read for Landlords.

Trusted By 40,000+ Housing Providers,

With 1,000,000+ Rental Units

Credit Checks For Landlords That Are As Easy As 1, 2, 3

Get Started

Sign up for a free FrontLobby Membership

Perform a Tenant Credit Check

Enter applicant’s details in less than 5 minutes

Receive a Credit Check on a Tenant

with all the information you need

Need Extra Screening?

Add a Background Check For $9

Background Checks Powered by Certn to ensure date integrity.

When to Pull a Credit Check on a Tenant?

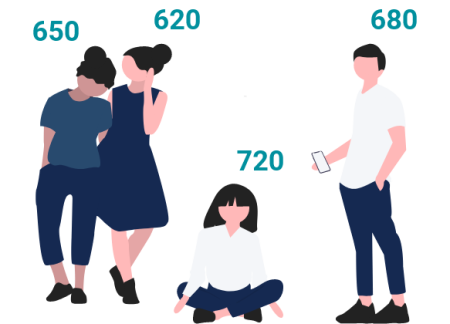

The average Tenant credit score is 650, and the odds of getting a responsible tenant exceed 90%. However, when Housing Providers get Renters who pay late repeatedly, miss payments altogether, or damage the property beyond normal wear and tear, it can cost them an average of $11,000 per eviction.

To attract and choose the right Renters, Housing Providers need a thorough, consistent and reliable process to screen prospective new Tenants. Applying FrontLobby’s 7 Tenant Screening best practices can help Housing Providers lower their risk of a costly decision and feel confident about their incoming new Renters. Continue Reading

What is a Rental Credit Check?

A Rental Credit Check is typically used by a Landlord to evaluate a Renters likelihood to pay rent on time. They also reveal whether an applicant owes rent to any previous Housing Providers.

Lending institutions, and Housing Providers, use your credit score to determine your credit worthiness. The idea is that the higher your credit score, the more likely you are to pay your bills. In the lending world, this means it’s easier for you to get a loan, with a lower interest rate. In the world of renting, the higher your score the more favorably you’ll be viewed by Landlords.

What is Included on a Tenant Credit Report?

A Tenant Credit Report includes both credit score as well as an applicant’s financial history. A credit score can be a numerical representation of a person’s credit risk at any given time. A typical credit score ranges from 300-900, and higher scores are viewed as more favorable.

Landlords can find key pieces of financial information by performing a credit check on a Tenant during the Tenant Screening process, including, creditworthiness, typically based on credit score, payment history, outstanding loans, credit cards, or other debts, any accounts in collections as well as any public records, including bankruptcies and consumer proposals.

Valued by Housing Providers, Loved by Renters

May 23rd, 2021

April 20th, 2022

September 22nd, 2022

June 2nd, 2020

November 19th, 2021

May 11th, 2021

August 20th, 2022

June 6th, 2022

November 20th, 2021

March 2nd, 2020

May 25th, 2021

June 2nd, 2021

March 6th, 2021

October 29th, 2022

January 31st, 2022

September 9th, 2022

December 7th, 2022

+ We are committed to earning 6 out of 5 stars from our members.

Credit Bureau Reporting FAQ

If You Still Have Questions, Visit Our Help Center Anytime

We believe so, and so do our members.

We are Canada’s first affordable Tenant credit check that is delivered in under 5 minutes with all the information you need and none of the gimmicks.

Our Credit Checks for Landlords are a long-form Equifax credit report that include score. They also include all the other information you need to choose the right Tenant for your vacancy, you will find current and former addresses, employment confirmation, credit history (tradelines), credit balances, collections, bankruptcies, inquires, aliases and Tenant Records.

Yes, it’s perfectly legal for landlords to perform tenant credit checks on prospective tenants. However, landlords can only perform a credit check with an applicant’s consent. Landlords should be up-front with their requests to perform a credit check and obtain written consent.

To perform a credit check you will need the applicants full legal name, date of birth and current address. If the applicant has lived at their current address for less than 6 months, their previous address should be used. A SIN/SSN number should be added when available, but please note a consumer is not legally required to provide their SIN/SSN on their tenant application. Please enter as much information as possible and double check that everything is typed correctly, as the more information you can provide, the higher probability it is we can find the credit record.

For the most part these terms mean the same thing. You can read all about it in our help center here.

It is free and quick to create a FrontLobby account. FrontLobby provides an internal Recordkeeping platform with tools to report rental payments to Credit Bureaus, pull Credit Checks and recover debts.

Landlords or Property Managers can sign up here

Tenants can sign up here

Rental credit checks and Tenant credit checks are identical. Both involve a potential Landlord ordering a copy of the Tenant’s credit report from a credit bureau such as Equifax. The Landlord is looking for information about the Tenant’s credit history and financial status. This information can help them decide whether or not a Tenant is a good candidate for the rental property.

Helping Housing Providers and Renters Prosper

Join our mission to improve the rental industry for everyone.