In-Depth Articles and Practical Resources

Enter your email below to get our latest updates and industry news, conveniently delivered to your inbox.

Why Landlords Should Report Rent Payments to Credit Bureaus

FrontLobby

Updated March 18, 2024

One of the most crucial elements towards building a good Landlord-Tenant relationship is the clear understanding of maintenance responsibilities.

Featured Resources

Latest Articles

Everything Landlords Need to Know About Tenant Screening

Tenant screening is often one of the least enjoyable aspects of managing a property. Yet, having a robust Tenant screening process is critical to minimizing risk and identifying the best fit for your rental.

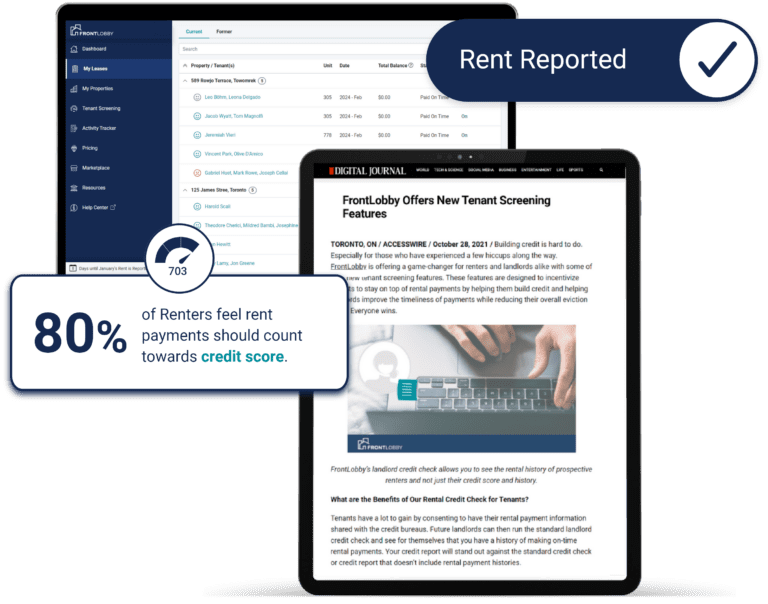

How Can a Landlord Report Tenants Rent Payments to Credit Bureaus

The ability for Landlords to report Tenant rent payments to credit bureaus is relatively new. But it is one that is making waves across the country as Landlords seek to attract Tenants with histories of timely payments and avoiding those who have long lines of late payments, delinquencies, and even evictions in their past.

How Does Rent Reporting Impact A Tenant’s Credit Report?

A credit report summarizes how promptly an individual pays their bills. Credit reporting agencies assign a credit score ranging from 300 to 850 based on bill payment habits and other factors in handling credit responsibly.

Tenant Screening Best Practices for Landlords and Property Managers

When a rental unit becomes vacant, a landlord or property manager needs to fill it with new occupants who will pay their rent on time every month and leave the property in excellent shape. To find tenants, property owners and managers may be inclined to run an ad, see who turns up to visit, and go with their intuition.

Why Landlords Should Report Rent Payments to Credit Bureaus

Rent reporting to credit bureaus is one of the easiest ways for Landlords to reduce income loss and reward their responsible Tenants with good credit. Landlords can lower payment delinquencies by 36%, while Tenants have reported bumps of more than 40 points in their credit score in a matter of months.

FrontLobby Strives for Responsible Innovation

FrontLobby will continue to provide the business services Landlords need to reduce income loss and reward their responsible Tenants with good credit. Moving forward Landlord Credit Bureau will only represent the credit reporting agency, which will maintain a database of rental records.

50k+ Housing Providers,

Representing 1M+ Rental Units

Helping Housing Providers and Renters Prosper

Join our mission to improve the rental industry for everyone.