Understanding California's New Rent Reporting Law AB 2747

A Guide for Landlords

- FrontLobby

- Published

Table of Contents

What is AB 2747?

Key Requirements for Landlords

Compliance Steps for Landlords

A Clear Statement of Offering Rent Reporting

Opt-In & Opt-Out Process

Required Tenant Notification Language

Inform Your Current Tenants About Their Rent Reporting Options

Credit Building Benefits for Renters

How to Offer Rent Reporting Services

How to Get Started

What is AB 2747?

AB 2747 is a California rent law designed to make Rent Reporting more accessible, helping Renters build credit while setting clear guidelines for Landlords. Rent is one of the largest recurring expenses for most people, yet it has historically not been reflected in credit scores. This law aims to change that by allowing Renters to strengthen their credit profiles through on-time rent payments.

For Renters, this new California law presents an opportunity to improve their credit without taking on debt. A stronger credit score can lead to better financial opportunities, including easier approval for loans and rental applications. For Landlords, offering Rent Reporting can encourage on-time payments and attract responsible Tenants.

By ensuring rent payments contribute to credit history, California’s rent law AB 2747 creates a practical way for Tenants to improve their financial standing while providing Landlords with a tool to promote timely rent payments.

Key Requirements for Landlords

Under AB 2747, Landlords must provide Tenants with written information about Rent Reporting at lease signing and at least once per year. This information must include:

- The cost to the Tenant, if any.

- Confirmation that Rent Reporting is optional.

- Information on how rent payments will be reported.

- The names of the Credit Bureaus that will receive rent payment data.

- A statement that Tenants may opt out at any time, with the condition that they cannot re-enroll for at least six months after opting out.

Inform your Tenants about their option to report rent payments under California’s rent law AB 2747 with a Tenant Notice.

AB 2747 Requirements

Landlords must charge no more than $10/month for reporting rent payments

Report on-time rent payments monthly to at least one Credit Bureau

Disclose to Tenants that their rent payments will be reported

Tenants must be provided with the option to opt-in or opt-out of reporting

FrontLobby Rent Reporting

Both paid and unpaid rent can be reported for just $1/month

Automated monthly reporting to four Credit Bureaus

Automated Tenant invites, payment notifications and rent reminders

Opt-in or opt-out any time by providing consent within the platform

Compliance Steps for Landlords

To comply with California’s rent law AB 2747, Landlords should take the following steps:

- Develop a Rent Reporting Policy: Establish clear procedures for offering Rent Reporting, including opt-in/out processes and fee structures.

- Update Lease Agreements: Ensure lease agreements include required Rent Reporting disclosures.

- Partner with a Reporting Agency: Work with a reputable Rent Reporting service like FrontLobby to ensure accurate and timely submissions to Credit Bureaus.

- Maintain Accurate Records: Keep detailed records of Tenant participation, opt-in/opt-out elections, and rent payment history to ensure compliance and resolve disputes.

A Clear Statement of Offering Rent Reporting

Communication around California’s rent law AB 2747 should be clear and easy to understand. Update your lease with a statement informing Tenants of their option to report rent payments.

Example Lease Clause:

“As required by California AB 2747, you have the option to have your on-time rent payments reported to a major Credit Bureau. This can help you build your credit history and improve your financial standing. If you choose to participate, rent payments will be submitted to Equifax, TransUnion, Experian, and Landlord Credit Bureau through FrontLobby. You may opt in or out at any time through FrontLobby or by submitting a written request to management. Once you opt out, you may only opt in again after six months.”

This clause:

- Clearly states that Rent Reporting is optional.

- Explains the benefits of Rent Reporting.

- Ensures Tenants understand their ability to opt in or out.

Without this clear statement, a lease agreement will not meet AB 2747 compliance standards.

Opt-In & Opt-Out Process

California’s rent law AB 2747 requires Landlords to provide a straightforward process for Tenants to opt in or out to report their on-time payments. Remember that consent is never required to report rental debts to the Credit Bureaus. Even if the Renter opts out of on-time reporting, a debt can still be reported without consent, which is not a violation of AB 2747. Now is the time to update your lease to include instructions for your Tenant.

Example Lease Clause:

“To participate in Rent Reporting, you must complete the Rent Reporting invitation sent to you via FrontLobby or submit the Election Form provided by management. You may opt in or out at any time through FrontLobby or by submitting a written request. Opting in allows us to report rent payments to Equifax, TransUnion, Experian, and Landlord Credit Bureau through FrontLobby. If you opt out, future rent payments will not be reported, but previously reported payments will remain on your credit history. Once you opt out, you must wait six months before opting in again.”

This ensures:

- Tenants have a clear and simple process to participate or withdraw.

- Transparency in how Rent Reporting affects their credit history.

Required Tenant Notification Language

In addition to a clear and optional offering, AB 2747 mandates that Landlords notify Tenants about Rent Reporting at lease signing and annually thereafter. Add a notification clause to your lease to inform Tenants they will receive annual communication about this new California rent law, AB 2747.

Example Lease Clause:

“Each year, you will receive written notification reminding you of your option to participate in Rent Reporting. This notification will be sent via FrontLobby or directly from the management team.”

This ensures compliance with AB 2747 and prevents misunderstandings between Landlords and Tenants.

Inform Your Current Tenants About Their Rent Reporting Options

With AB 2747 in effect, it is important to inform your existing Tenants about their option to report rent payments with a Tenant Notice. This notice should clearly explain the benefits of Rent Reporting, outline the process for opting in or out, and provide details on which Credit Bureaus will receive the payment data. Ensuring that Tenants are aware of their rights and opportunities under AB 2747 not only keeps you compliant with the law but also helps Renters take advantage of a valuable tool for building their credit history.

Credit Building Benefits for Renters

For Renters with little or no credit history, Rent Reporting allows them to establish positive credit using payments they already make. Unlike credit cards or loans, rent payments do not come with interest charges, making Rent Reporting a safe and effective way to build credit over time. A stronger credit profile can also help Tenants secure lower interest rates, qualify for a mortgage, and reduce security deposit requirements when renting a new home.

A study by the Credit Builders Alliance and Citi Foundation found that 79% of participants saw their credit scores increase, with an average rise of 23 points. California Law AB 2747 empowers you to help your great Tenants with a stronger financial future.

How to Offer Rent Reporting Services

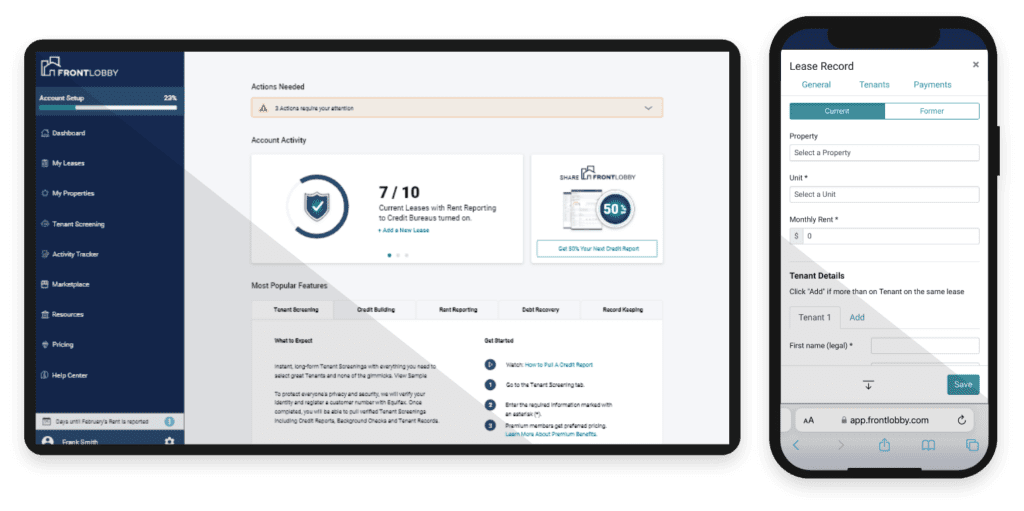

Landlords can easily offer Rent Reporting through FrontLobby, a platform designed to help both Landlords and Tenants. FrontLobby ensures that rent payments are accurately reported to Credit Bureaus, providing a seamless solution for all parties involved.

How to Get Started with FrontLobby:

- Create an account on the FrontLobby website.

- Add your rental property and invite Tenants to participate.

- Secure Tenant consent to begin Rent Reporting.

- Track payments and reports through the FrontLobby dashboard.

- Encourage Tenants to stay enrolled to continue building their credit over time.

By offering Rent Reporting through FrontLobby, Landlords adhere to California Law AB 2747 while promoting financial responsibility and timely rent payments.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Did You Enjoy This Article?

Then You Will Love Our Newsletter