Does Paying Rent in the US Build Credit?

Rent Reporting Gives Renters the Boost They Deserve

- FrontLobby

- Published

- Updated May 24, 2024

Table of Contents

Why Does Credit Matter?

Who Benefits from Improved Credit?

What is a Good Credit Score?

What Factors Contribute to Building Credit?

How Does Paying Rent Build Credit?

How to Choose a Rent Reporting Platform?

The Importance of a Tradeline

Is Rent Reporting the Same as Paying Rent with a Credit Card?

Calculating Your Rent Score After Making Regular Payments

Build Credit with Rent Payments Through FrontLobby

Why Does Credit Matter?

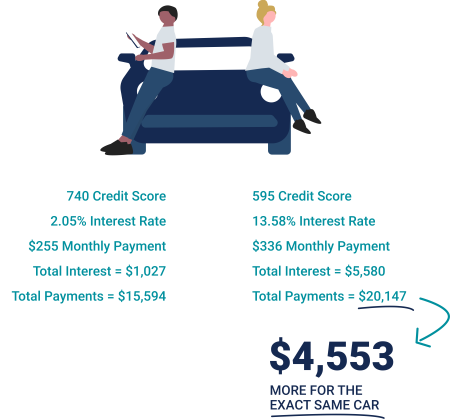

Having a good credit score is critical for many aspects of life, from renting an apartment to getting a loan. Credit scores not only affect how lenders view you, but also to what degree you can be approved for certain financial milestones. A high credit score signals to lenders that you are responsible with your money and can manage your finances well. On the other hand, a low credit score can make it difficult to get the financing and loans you need for major purchases such as homes or cars and may even cause you to be charged higher interest rates or insurance premiums.

Who Benefits from Improved Credit?

Not everyone has a good credit score for a variety of reasons. People may have missed payments, been late on payments, or have too much debt relative to their income. Some people may have had bad luck and incurred unexpected expenses that they couldn’t pay off in time, while others may not understand the importance of building credit and making timely payments. Without a strong understanding of the factors that contribute to a good credit score, it can be difficult to build and maintain good credit.

Students and recent immigrants may find it especially difficult to build a good credit score, as they often lack a credit history. Credit history is one of the components used to calculate credit scores, so without any evidence of being responsible with finances, lenders have no way to judge an individual’s ability to manage money and loan repayment.

To help address these challenges, FrontLobby created its signature Rent Reporting service. As the first company of its kind, FrontLobby allows Renters and Housing Providers to report rent payments to Credit Bureaus, like Equifax. This enables Renters to build credit by paying rent and helps them establish a better financial profile without taking on debt.

Renters can sign up to start building credit. Get Started

Housing Providers can sign up to help their Renter build credit. Get Started

What is a Good Credit Score?

Credit scores in the United States are determined using a scoring model developed by the Fair Isaac Corporation, commonly referred to as FICO. A good credit score is generally considered to be above 670. This score is used by lenders to estimate someone’s creditworthiness and determine their eligibility for loans, mortgages, and other credit products. A good credit score typically indicates a responsibility in managing finances, though the exact number varies from lender to lender. It’s important to note that having a good credit score doesn’t guarantee approval for any particular loan or financial product, but it does make it more likely that someone will have access to competitive offers.

What Factors Contribute to Building Credit?

There are several factors that contribute to a person’s credit score in Canada, which is largely based on their credit history. Payment history, amount owed, and length of credit history are all important considerations that are taken into account. Additionally, having various types of credit accounts (such as installment loans, mortgages, and revolving lines of credit) can help demonstrate responsible financial management. Paying bills on time, having low balances due and limiting new applications for credit can also help to improve a person’s credit score.

Unfortunately, many individuals have little to no credit history due to not having access to financial products or being unaware of their options for establishing credit. The good news is that there are steps you can take to improve your score over time. One of the easiest ways is to build credit with rent payments, a relatively new possibility, but one that has proven to increase score by 33pt to 84pt within the first six months of reporting.

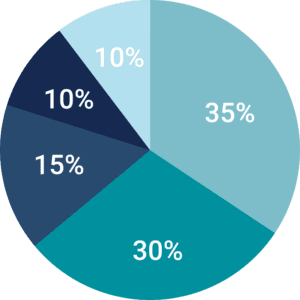

- Payment History (~35%) – Your debt payments generally make up the biggest portion of your credit scores. As such, be sure to pay your debts (including your rent) on time and in full to help build a positive payment history.

- Debt-To-Credit Ratio (~30%) – The more unpaid debt you carry, the higher your debt-to-credit ratio. This could potentially negatively affect your credit scores. In general, lenders like to see a debt-to-credit ratio of 30% or below.

- Credit History (~15%) – While your account history generally has less of an impact on your credit scores, it can still be a deciding factor for landlords and lenders. Essentially, the longer and more responsibly you use a credit account, the more likely it may improve your credit scores.

- Credit Inquiries (~10%) – When lenders check your credit, a hard inquiry goes on your report, which may drop your credit scores slightly. In general, it’s best not to apply for too many new credit products within a short period of time.

- Public Records (~10%) – Bankruptcies, debts in collections, lawsuits, and other derogatory remarks on your credit report can also impact the calculation of your credit scores.

How Does Paying Rent Build Credit?

Many Renters do not know they can build credit by paying rent. However, paying rent on time is a proven way to help build a person’s credit score. A recent tradeline study, conducted by Equifax, released findings that indicate Rent Reporting may benefit millions. According to the findings, nearly half of Renters who use the FrontLobby platform are currently scoreable based solely on rental data reported into Equifax. This indicates that these individuals have no other credit accounts listed in their Equifax credit report and are only able to build their credit scores through rental information reported using FrontLobby. If these Renters stopped reporting through FrontLobby, they could become “credit invisible” over time unless they established additional credit and had it reported to Equifax.

“By reporting rent information to Equifax with FrontLobby, 48 per cent of these renters were able to establish an Equifax credit score based only on the reported rental information. When renters can provide a clear rent payment history, lenders may be better able to evaluate a consumer’s financial opportunities,” states Sandy Kyriakatos, Equifax Canada’s Chief Data Officer. “This could result in potentially life-changing benefits for these consumers when applying for credit at pivotal moments such as applying for a mortgage, financing an education, or buying a car.”

Having rent payments reported to the Credit Bureaus, like Equifax, can help Tenants build credit by paying rent. The ongoing, timely payments help with factors such as payment history and amount owed, which directly influence a person’s credit score. As rent payments are reported on a regular basis, this demonstrates responsible and timely payments and can have a positive effect on their overall credit health over time.

How to Choose a Rent Reporting Platform

It’s important to understand that not all rent reporting platforms will necessarily improve your credit score. Depending on the platform and how it reports rent payments to credit bureaus, your rent payments may not have a positive effect on your score. In some cases, rent payment information may be reported only as “alternative data” which is considered by lenders but does not directly contribute to a credit score increase.

The Importance of a Tradeline

Tradelines report any kind of accounts with loan balances and account payment histories such as rent, mortgage loans, car loans, student loans, and credit card accounts. They will generally include information such as the opening date of the account, the current balance, and any late payments or defaults associated with the account. By reporting your rent payments to Credit Bureaus as tradelines, lenders will be able to assess your payment habits more accurately than if your rent payments were simply reported as a one-time payment. This can help you achieve a higher credit score in the long run.

When looking for a rent reporting platform to build your credit score by paying rent, you should pay particular attention to whether or not the service offers tradelines. It is also important to choose a service that has a proven track record of working directly with the Credit Bureaus. FrontLobby works directly with Credit Bureaus, like Equifax to help Renters build credit by paying rent.

Renters can sign up to report rent payments here. Get Started

Housing Providers can sign up to report rent payments here. Get Started

Is Rent Reporting the Same as Paying Rent with a Credit Card?

No, Rent Reporting is not the same as paying rent with a credit card. Paying rent with a credit card is simply using your card to make payments directly from your bank account. It does not typically provide a report of that payment to the Credit Bureaus in the same way that a rent reporting platform does, nor does it offer additional benefits such as tradeline reporting. On the other hand, Rent Reporting platforms are designed to provide information on your rental payments to the Credit Bureaus, as tradelines, so they can be used when calculating your credit score.

Calculating Your Rent Score After Making Regular Payments

Making regular payments on time is one of the most important factors in calculating your credit score. Every payment that you make on time helps to build a positive credit history and will eventually result in an increase to your score. With Rent Reporting services, like FrontLobby, your rental payments are reported directly to the Credit Bureaus, providing an even more direct way for your good payment behavior to be taken into account when calculating your score. In addition, paying rent regularly helps demonstrate financial stability which can also enhance your creditworthiness.

Renters see an average credit score increase of 33pts to 84pts.

Build Credit with Rent Payments Through FrontLobby

FrontLobby provides a much-needed connection between rent payments and credit scores. With FrontLobby, rent payments are treated the same way as your credit card payments on your credit report. When you make a payment, a registered tradeline will appear on your Equifax Credit Report and the payment will contribute to your overall payment history. This helps you to build or improve your credit by making consistent, timely payments each month. You’ll also have access to a detailed overview of your payment history and alerts so you can always stay up to date on payments. All in all, FrontLobby offers an easy-to-use solution for those looking to build credit with rent payments.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Did You Enjoy This Article?

Then You Will Love Our Newsletter