Landlord Lessons: If I knew Then What I Know Now

A Must-Read Recap with Tips, Red Flags, and Tools for Smarter Rentals

- FrontLobby

- Published

Table of Contents

Mistakes, Red Flags, and What to Do Instead

Hart Togman — Trust the Fit, Not Just the File

Kayla Andrade — Know the Rules, Protect Your Rentals

Kevin Costin — Don’t Ignore the Red Flag

Danielle & Kory — Inherit the Property, Inherit the People

Watch the Full Recording

Top Questions from the Landlord Community

Smarter Landlording Starts Here

Rent Reporting Helps Landlords

Mistakes, Red Flags, and What to Do Instead

Every Landlord has that one moment they wish they could take back—a Tenant they shouldn’t have approved, a property they didn’t fully vet, or a red flag they ignored. In this webinar, seasoned rental pros shared the lessons they learned the hard way, along with the practical changes they’ve made to avoid repeating those mistakes. From screening smarter to managing inherited Tenants, here’s what they had to say—and what you can take away.

Hart Togman — Trust the Fit, Not Just the File

One of the biggest traps Landlords fall into is chasing “perfect” Tenants on paper—strong credit scores, solid income, professional references. But as Hart shared, great numbers don’t always equal great Renters.

In his experience, a couple that looked flawless on paper turned out to be the wrong fit (to say the least), while newcomers to Canada with no credit history became his most respectful, reliable Tenants. The takeaway? Screening should go beyond surface-level stats.

What to do instead:

- Focus on Tenant fit, not just financials. Consider communication style, responsiveness, and whether they align with your expectations as a Housing Provider.

- Use verified screening tools—not documents sent directly from Tenants—to confirm income, credit, and references.

- Don’t ignore your instincts. If something feels off, take the time to dig deeper.

Set Expectations Early and Support Responsible Tenants

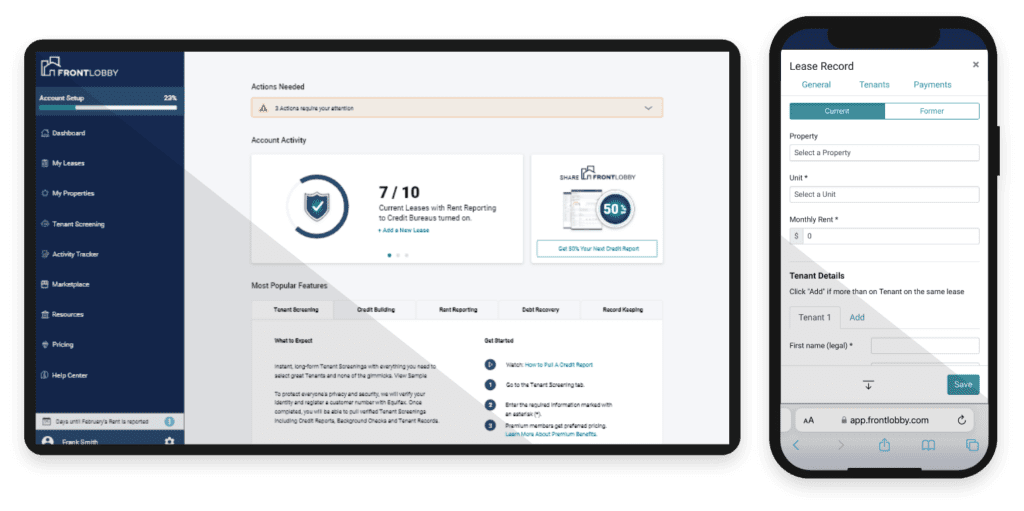

Tools like Rent Reporting can support this approach by encouraging transparency and accountability from day one. When Tenants know their payments are being reported to Credit Bureaus, it helps foster clear communication—and for newcomers or credit-invisible Renters, it offers a way to build credit through consistent, on-time payments.

Want to learn why Landlords are choosing to report rent payments and how it can benefits both you and your Tenants?

Kayla Andrade — Know the Rules, Protect Your Rentals

When it comes to being a Landlord, staying informed isn’t optional—it’s essential. Kayla spoke about her early days as a rental property owner, when she didn’t fully understand the laws or her rights, and how that lack of knowledge led to costly missteps. That experience sparked her journey into Landlord advocacy, and her message is clear: the more you know, the better you can protect your investments.

From local bylaws to federal policies, the landscape is constantly changing—and keeping up can make the difference between profit and problems.

What to do instead:

- Stay up to date on municipal, provincial, and federal housing policies that impact Landlords.

- Get involved with advocacy groups like Ontario Landlords Watch to have a voice in local and national conversations.

- Build relationships with your elected officials so Landlord concerns are heard.

- Use tools like Rent Reporting to promote accountability and encourage on-time payments.

Promote Accountability with Consistent Reporting

Kayla highlighted how Rent Reporting not only encourages timely payments but also gives Landlords a way to protect their income without relying solely on formal enforcement. Tools like FrontLobby’s Rent Reporting help reinforce lease expectations, improve Tenant communication, and provide a positive credit-building opportunity for renters who pay on time.

If you want to learn more about Rent Reporting you can create a free Landlord account with FrontLobby.

Kevin Costin — Don’t Ignore the Red Flags

Sometimes the biggest mistakes are the ones you saw coming but chose to overlook. Kevin shared a powerful and painful lesson about what can happen when red flags are dismissed. A single bad screening decision cost him over $400,000 in damages and 16 months of stress—after a Tenant set fire to his rental property.

His story is a reminder that screening is not just about checking boxes—it’s about protecting your property, your finances, and your peace of mind. If something feels off, it probably is.

What to do instead:

- Never accept a credit report directly from a Tenant—use third-party platforms for reliable data.

- Always contact multiple past Landlords, not just the most recent one.

- Watch for red flags like rushed timelines or unwillingness to view the unit in person.

- Trust your instincts. Screening tools matter, but your judgment is just as important.

Danielle & Kory — Inherit the Property, Inherit the People

Buying a rental property isn’t just a real estate transaction—it’s a people transaction too. Danielle and Kory emphasized that when you purchase a rental with existing Tenants, you’re stepping into an already-established dynamic. Ignoring that reality can lead to friction, missed red flags, or even long-term financial consequences.

They shared stories of how taking the time to evaluate inherited Tenants helped them avoid major issues—and how proactive communication can turn a potential risk into a long-term win.

What to do instead:

- Don’t just vet the property—vet the Tenants. Talk to neighbors, review rent payment history, and pay attention to Tenant behavior.

- Set clear expectations early, even with Tenants you didn’t place yourself.

- If you’re using a Property Manager, stay involved. Set expectations and don’t assume everything is being handled.

- Consider hiring a leasing agent who specializes in thorough screening and Tenant transitions.

Watch the Full Recording

Want more than just the highlights? The full recording includes deeper insights, real stories, and additional strategies that didn’t make it into the summary above.

You’ll hear firsthand how experienced Landlords are handling Tenant screening, avoiding costly mistakes, managing inherited renters, and setting clearer expectations. It’s a practical, straight-talking conversation for anyone looking to protect their rental business and make smarter decisions moving forward.

Top Questions from the Landlord Community

During the live session, Landlords had a chance to ask real questions about the challenges they’re facing. Here are a few of the top questions—and the expert advice that came with them:

Q: How can I make sure a Tenant actually moves out when agreed?

Set clear expectations upfront. Be specific about lease terms—especially for short-term agreements—and avoid using forms like the N11 at move-in, as they may not hold up legally. Clarity from the start is key to a smooth move-out.

Q: What are your go-to pre-screening questions?

Start with: “Why are you moving?” and “What’s your relationship like with your current Landlord?” These simple questions reveal more than you might expect about a Tenant’s mindset, communication style, and rental history.

Q: How do I recover unpaid rent?

Serve the appropriate non-payment notice (N4), then file an L1 application with the Landlord and Tenant Board. Reporting the Tenant’s payment history through services like FrontLobby can also encourage repayment and promote accountability.

Q: A Tenant keeps damaging appliances—what can I do?

Obtain a professional inspection to document misuse. Send a formal notice outlining the issue and corrective expectations. If the behavior continues, file an N5 application with supporting evidence. Always document thoroughly and seek legal advice when needed.

Smarter Landlording Starts Here

Being a Landlord means constantly learning—and sometimes learning the hard way. But the smartest Landlords don’t just gain experience, they apply it. Whether it’s screening more carefully, setting clearer expectations, or staying informed about your rights and responsibilities, small improvements can make a big difference.

Use the lessons shared here to strengthen your process, protect your investments, and build better rental relationships—because the best mistakes are the ones you never have to make yourself.

Rent Reporting Helps Landlords

From missed red flags to costly Tenant mistakes, the lessons shared by seasoned Landlords all point to one thing: proactive tools make all the difference. Rent Reporting helps set expectations, encourage on-time payments, and protect your rental income. Book a meeting with a FrontLobby expert to learn how to put these lessons into action.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Did You Enjoy This Article?

Then You Will Love Our Newsletter