Why Landlords Should Report Rent Payments to Credit Bureaus

Rent Reporting Benefits Both Landlords and Tenants

- FrontLobby

- Published

- Updated March 18, 2024

Table of Contents

The Importance of Credit

Why Renters May Struggle to Establish Credit

Add Rent to Credit Reports

Motivate On Time Rent

Use Rent Credit Reporting to Secure the Right Tenants

Tenant Screening, Landlord Credit Checks and Recordkeeping

Reward Responsible Tenants

How Landlords Can Report Rent Payments to Credit Bureaus

The Future of Rent Reporting

Valued By Housing Providers, Loved By Renters

Rent Reporting to credit bureaus is one of the easiest ways for Landlords to reduce income loss and reward their responsible Tenants with good credit. Landlords can lower payment delinquencies by 92%, while Tenants have reported bumps of more than 70 points in their credit score in a matter of months.

Let us look at why Tenants value good credit and how Landlords can help their renters boost credit. At the same time, Landlords can improve their ability to run profitable rental businesses.

The Importance of Credit

Buying a first home—for many, it is one of life’s biggest milestones. However, without a strong credit record, renters’ dreams of home ownership may be left unfulfilled.

As people build credit, they can gain better access to mortgages, as well as qualify for lower fees and interest rates on credit cards and other lines of credit. These advantages open the door to new opportunities and make it easier to accumulate wealth.

Building good credit takes time, consistency, a mixture of credit accounts and solid financial habits. For example, paying monthly bills on time regularly usually increases a person’s credit score. Many renters pay their bills on time every month and get credit for it. But historically, Tenants have not received credit for their largest monthly payment of all. Typically, 30% to 40% of a Tenant’s income goes toward paying rent to their Landlord.

Typically, 30% to 40% of a

Tenant’s income goes toward

paying rent each month.

Why Renters May Struggle to Establish Credit

Even for Tenants who always pay their full rent on time, Landlords have not had the means and tools to report rent payments to credit bureaus. This has deprived renters of a major opportunity to raise their credit score.

Today, more Tenants than ever are staying in the rental market. This is partly for lifestyle reasons and partly because of higher housing prices and tougher criteria for obtaining mortgages. Over time, these renters fall behind homeowners, whose mortgage payments get recorded by credit agencies. Many of these Tenants descend into a downward spiral of spending more and saving less, as they use much of their income to pay not only rent, but also the interest and fees associated with less desirable credit cards and loans.

But now, with support from Landlords, Tenants have a liberating new way to improve their credit score.

Add Rent to Credit Reports

In a welcome new development, the major credit agencies now accept rent payment history from Landlords. That history gets included on a Tenant’s consumer credit report.

For Tenants, this is a game-changer. Tenants want their rent payments reported. Their positive payment history improves their credit records, giving them access to attractive amenities and money-saving financing rates. Renters will soon demand that their Landlords report rent payments to the credit agencies, giving them the same credit building opportunities as those with mortgages.

For Landlords, this is an opportunity. By reporting Tenant rent payments, Landlords can differentiate their property from others in the market. In fact, their units will be more attractive to prospective Tenants with good credit scores. Those who report rent payments to the credit agencies will have a competitive advantage in attracting and retaining good Tenants. It’s a simple way to add value for both Landlords and Tenants.

Landlords and Property Managers know how heavily regulated the rental industry is. When Tenants default on their rent, Landlords must go through a long and costly legal process to remove the Tenants and capture missed payments. Late payment fees are prohibited or limited and often ineffective as a deterrent. But Landlords who report rent payments to credit agencies see a higher incidence of on-time rent payments. This means less time spent chasing down Tenants, collecting late fees or filing evictions.

Motivate On Time Rent

Reporting rent payments to credit bureaus gives Landlords an advantage. When Tenants understand that timely payments increase their credit score and late or missed payments decrease it, they have a powerful incentive to keep their end of the rental bargain.

Renters know that, as easily as they can build credit each month, late or missing rent payments can weaken their credit file. Those Tenants may soon find themselves being passed over or paying more for housing and other necessities.

When Landlords report rent

through FrontLobby, their

delinquencies can decline by 92%

When Rent Reporting is part of a rental agreement, Landlords can end up with more financially responsible Tenants. In turn, this can also translate into fewer instances of property damage.

When renting out their properties, Landlords usually want two things – responsible Tenants who will take good care of their property, and to avoid any damage to their investment. A screening process that includes a Credit Check can help ensure both of these things.

Use Rent Credit Reporting to Secure the Right Tenants

Reporting rent payments helps Landlords and Property Managers attract conscientious Tenants. These Tenants see it as a welcome way to boost their credit score. When Landlords offer Rent Reporting to incoming new renters, the most trustworthy and reliable Tenants are more likely to apply.

Since Tenant Screening is often a Landlords least favorite part of the job, anything that can make it easier is a bonus. Rent Reporting does just that. It’s a simple way to encourage fiscally responsible renters to apply.

Tenant Screening, Landlord Credit Checks and Recordkeeping

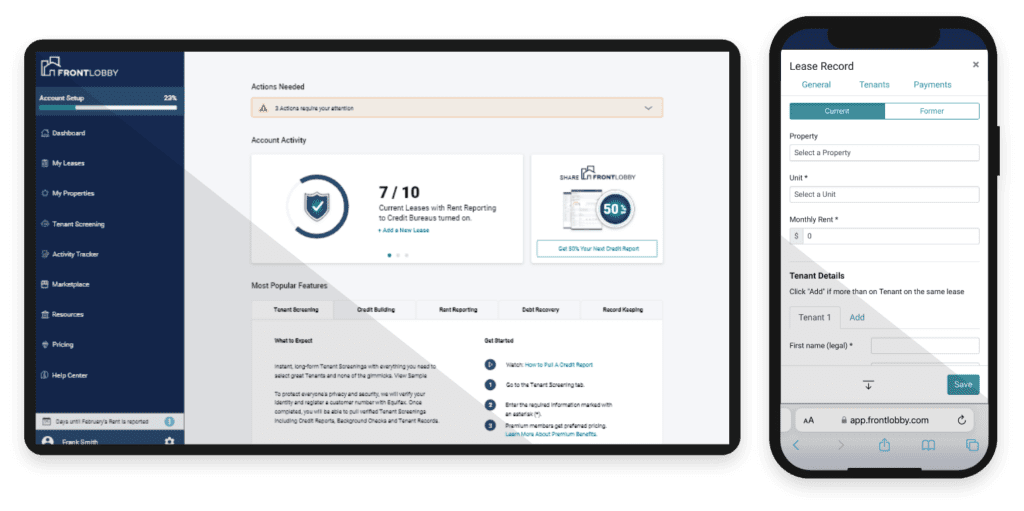

Landlords using the FrontLobby platform to report rent can also conduct Tenant Screening, including pulling Equifax Credit Reports, performing data-driven background checks and searching verified Tenant Records. Landlords can create a free account with FrontLobby here.

Landlords can also keep organized records of Tenants’ rent payment habits. FrontLobby’s Recordkeeping tool saves Landlords and Property Managers time, enabling them to focus on activities that are more productive than managing rent payments.

Reward Responsible Tenants

When Tenants make timely full payments, they deserve to be rewarded. When Landlords offer rent credit reporting, they help responsible Tenants unlock future credit-related rewards for themselves and their loved ones. This brings renters one step closer to financial freedom.

How Landlords Can Report Rent Payments to Credit Bureaus

FrontLobby is a turnkey, user-friendly platform designed to improve the rental industry for everyone. Rent payment history added to FrontLobby each month can be shared with Landlord Credit Bureau and is added to the Tenant’s Equifax credit report as a trade line.

FrontLobby also offers valuable education and assistance, such as providing Landlords with sample disclosures they may use to explain to Tenants the benefits of reporting rent. FrontLobby also provides examples of lease provisions that allow Tenants to better understand their responsibilities under their lease agreement and to maximize the value of Rent Reporting to build credit.

Besides the Rent Reporting feature, FrontLobby offers two additional services that empower Landlords and Property Managers to secure better renters, reduce the frequency and impact of delinquencies, and drive operating efficiencies. These services include Tenant Screening for fast, easy and affordable Landlord credit reports, as well as Debt Reporting to help Landlords recover debts owed by former Tenants.

The Future of Rent Reporting

In California, a new law called SB 1157 requires Landlords to give Tenants in lower-income households the option to have their rent payments reported. It will be interesting to see whether other U.S. states will follow suit or whether similar legislation will be enacted in Canada.

Either way, more and more Landlords and Property Managers offer Rent Reporting, to the benefit of both Landlords and Tenants. Including rent on Tenants’ credit records is a win for everyone.

Disclaimer

The information provided in this post is not intended to be construed as legal advice, nor should it be considered a substitute for obtaining individual legal counsel or consulting your local, state, federal or provincial tenancy laws.

Did You Enjoy This Article?

Then You Will Love Our Newsletter